The global anti money laundering market size is expected to reach USD 1.99 billion by 2025, registering a CAGR of 13.6% over the forecast period according to a new report by Grand View Research, Inc. As the detection and prevention of money laundering threats increase with improvements in law enforcement activities, criminals and corrupt individuals are taking substantial care to conceal the sources of their illicit wealth.

Global concerns about the growing incidences of sophisticated organized crimes, terrorism, and corruption and their negative impact on peace, security, and development of countries globally have signaled a need for concerted action by governments. To meet the various compliance requirements set by governments, organizations are increasingly adopting solutions such as fraud detection and anti-money laundering. These solutions are anticipated to establish procedures to curb practices facilitated by cyber-criminals and corrupt individuals, reducing the concerns of converting or disguising illegally obtained funds as legitimate income.

AML solutions are expected to aid governments in mitigating the risk of anonymity in transaction and fund transfers that facilitate money laundering activities. This would help reduce the use of cash-based activities involved in activities such as drug trafficking, human smuggling and trafficking, and illicit retail transactions. Moreover, AML is expected to help enterprises to decrease the risk associated with cross-border transactions and the exploitation of virtual currency due to threats. AML solutions would subsequently curb activities such as ransomware, Distributed Denial-Of-Service (DDoS), and malware attacks conducted for money laundering or fraud.

The use of advanced technologies such as anonymous online payment portals, online banking platform, and Peer-to-Peer (P2P) money transfer applications for mobile phones have led to a notable rise in the number of e-transactions taking place across the globe in the past few years. While these developments have eased the way funds can be transferred between two nodes, they have also created vulnerabilities and several new ways for illegally transferring money that are more difficult to detect. Moreover, hackers are potentially transferring or withdrawing money, leaving a minute or no trace of an IP address with the use of anonymizing software and proxy servers. Thus, it is becoming increasingly difficult to detect or trace money laundering activities.

To protect citizens, financial organizations, and businesses from such threats, major nations worldwide are making continuous efforts to ensure that financial and other institutions comply with AML requirements. Moreover, several government regulators have started focusing on advanced FinTech solutions to detect and report financial crimes. Owing to the rising intensity, frequency, and sophistication of money laundering and illicit trading activities, organizations are adopting advanced technologies as legacy solutions fail to provide sufficient security and soon become obsolete.

Moreover, the deployment of advanced technology could boost data security and transparency in financial operations. Regulatory agencies and FinTech companies are also increasingly collaborating to improve Know Your Customer (KYC) and Customer Due Diligence (CDD) platforms. Thus, technologies such as authentication, smartphone-based context-aware authentication, and behavior analysis, as well as biometrics are anticipated witness increased traction, subsequently fueling the growth for anti money laundering market.

Browse Details of Report, Please Visit @ https://www.grandviewresearch.com/industry-analysis/anti-money-laundering-market

Key Takeaways from the report:

- The global market for anti-money laundering was valued at USD 857.2 million in 2018 and is expected to register a CAGR of 13.6% from 2019 to 2025

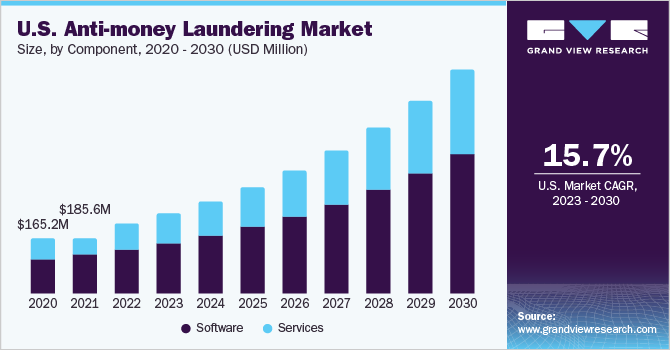

- The software component segment accounted for the largest revenue share of over 62% in 2018

- The customer identity management product type segment accounted for the largest revenue share of over 32% in 2018

- The cloud deployment segment is anticipated to register the highest CAGR of 16.0% over the forecast period

- The North American market accounted for the largest revenue share of over 48% in 2018

- The market for anti-money laundering is currently dominated by key industry players including Accenture, ACI Worldwide, Inc.; NICE Actimize, Tata Consultancy Services Limited, and SAS Institute Inc.

Request For Free Sample Report @ https://www.grandviewresearch.com/industry-analysis/anti-money-laundering-market/request/rs1

Grand View Research has segmented the global anti money laundering market on the basis of component, product type, deployment, end use, and region:

Anti Money Laundering Component Outlook (Revenue, USD Million, 2015 – 2025)

- Software

- Services

Anti Money Laundering Product Type Outlook (Revenue, USD Million, 2015 – 2025)

- Transaction Monitoring

- Customer Identity Management

- Currency Transaction Reporting

- Compliance Management

Anti Money Laundering Deployment Outlook (Revenue, USD Million, 2015 – 2025)

- Cloud

- On-Premise

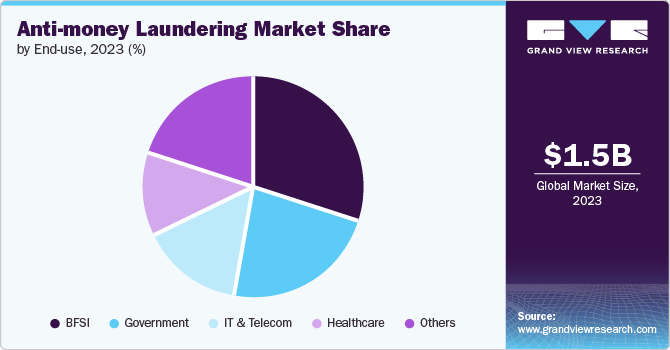

Anti Money Laundering End-Use Outlook (Revenue, USD Million, 2015 – 2025)

- IT & Telecom

- Healthcare

- Government

- BFSI

- Others

Anti-Money Laundering Regional Outlook (Revenue, USD Million, 2015 – 2025)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- Asia Pacific

- China

- India

- Japan

- Latin America

- Brazil

- Mexico

- MEA

List of Key Players in Anti Money Laundering Market Market

- Accenture

- ACI Worldwide, Inc.

- NICE Actimize

- Tata Consultancy Services Limited

- Trulioo

- Cognizant

- SAS Institute Inc.

- Fiserv, Inc.

- Oracle

- Open Text Corporation

- Experian Information Solutions, Inc.

- BAE Systems

Browse Related Reports :

Robotic Process Automation Market Size, Share & Trends Analysis Report By Type (Software, Service), By Application (BFSI, Retail), By Organization, By Service, By Deployment, By Region, And Segment Forecasts, 2020 – 2027

https://www.grandviewresearch.com/industry-analysis/robotic-process-automation-rpa-market

IT Asset Disposition Market Size, Share & Trends Analysis Report By Asset Type (Computers/Laptops, Mobile Devices), By End Use (BFSI, IT & Telecom), By Region, And Segment Forecasts, 2019 – 2025

https://www.grandviewresearch.com/industry-analysis/it-asset-disposition-market

About Grand View Research

Grand View Research provides syndicated as well as customized research reports and consulting services on 46 industries across 25 major countries worldwide. This U.S.-based market research and consulting company is registered in California and headquartered in San Francisco. Comprising over 425 analysts and consultants, the company adds 1200+ market research reports to its extensive database each year. Supported by an interactive market intelligence platform, the team at Grand View Research guides Fortune 500 companies and prominent academic institutes in comprehending the global and regional business environment and carefully identifying future opportunities.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1-415-349-0058, Toll Free: 1-888-202-9519

Address:201, Spear Street, 1100

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/anti-money-laundering-market