Blockchain Insurance Market worth USD 25315.55 Million by 2029: Market Dynamics, Technological Advancements, Trends, Competitive Landscape Regional Outlook

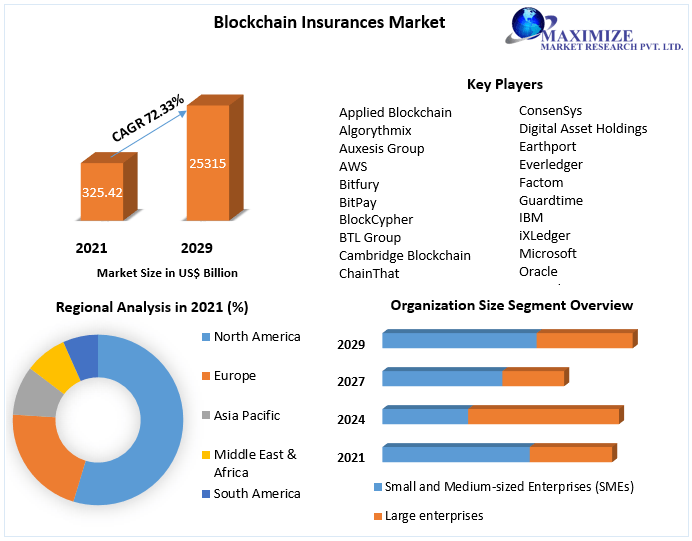

Pune, 5, Dec 2022: Maximize Market Research, a leading Information Technology, and Telecommunication consulting firm, has released the global Blockchain Insurance Market report. According to MMR, the Blockchain Insurance Market was valued at USD 325.42 Million in 2021, and it is expected to reach USD 25315.55 Million by 2029, exhibiting a CAGR of 72.33% during the forecast period (2022-2029). The report provides insights into industry trends, major sectors, and possible investments in a variety of fields, as well as demand, regional landscapes, and market pressures.

For critical insights on this market, request for methodology here @ https://www.maximizemarketresearch.com/request-sample/11489

Blockchain Insurance Market Scope and Research Methodology

The global Blockchain Insurance Market report provides a comprehensive overview of significant drivers, restraints, potentials, challenges, and trends in the Blockchain Insurance Market Industry, as well as future competitive analyses, assisting customers in identifying business opportunities and developing market strategies. The Blockchain Insurance Market research report covers the service type, growth trend, industrial engineering, major competitors, industrial chain structure, industry overview, industry national policy, planning analysis, and the most recent dynamic analysis. The analysis depends heavily on both primary and secondary sources of data. The bottom-up approaches are used to validate the information and to reach the final analysis.

Blockchain Insurance Market Overview

Blockchain insurance is a distributed record-keeping technique in which the data is encrypted. Data may be shared in real time between numerous parties in a trustworthy and verifiable way, resulting in significant efficiency advantages, cost savings, transparency, faster payouts, and fraud reduction. Additionally, Blockchain can assist new insurance approaches in developing better markets and goods.

Blockchain Insurance Market Dynamics

Blockchain implementation in insurance is one of the cutting-edge techniques for reducing fraud, mitigating risk, and increasing customer satisfaction. The number of fraudulent acts in the insurance industry is growing. It makes a compelling case for incorporating blockchain technology into its processes. To prevent fraudulent claims, insurance firms must upgrade the antiquated legacy systems that are currently in place. Blockchain provides a decentralized public ledger that may be shared by many untrustworthy parties. As a result, it might be used to detect fraud and eliminate errors.

Additionally, because blockchain technology is built on the concept of validation, it may be used to prove the legality of insurance customers’ policies by providing a detailed historical record of a policyholder’s previous transactions. As a result, blockchain technology improves the identification and prevention of fraud. As a result, the insurance industry is likely to increase in the next years.

Blockchain Insurance Market Segmentation

By Provider

- Application and solution provider

- Middleware provider

- Infrastructure and protocols provider

By Application

- GRC management

- Death and claims management

- Identity management and fraud detection

- Payments

- Smart contracts

- Others (content storage management and customer communication)

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

Blockchain Insurance Market Regional Insights

With a revenue share of more than 42% in 2021, North America led the global blockchain insurance market. Rising insurance agency initiatives to educate insurers on the benefits of using blockchain technology, high adoption in the finance sector, rising skilled expertise for cryptocurrencies, and rising adoption in Canada and the United States are all contributing to the region’s global blockchain in insurance market growth.

Blockchain Insurance Market Key Competitors:

- Applied Blockchain

- Algorythmix

- Auxesis Group

- AWS

- Bitfury

- BitPay

- BlockCypher

- BTL Group

- Cambridge Blockchain

- ChainThat

- Circle

- ConsenSys

- Digital Asset Holdings

- Earthport

- Everledger

- Factom

- Guardtime

- IBM

- iXLedger

- Microsoft

- Oracle

- RecordsKeeper

- SafeShare Global

- SAP

- Symbiont

Key questions answered in the Blockchain Insurance Market are:

- What is Blockchain Insurance?

- What is the growth rate of the Blockchain Insurance Market during the forecast period?

- What is the nature of competition in the Blockchain Insurance Market industry in developed economies and developing economies?

- Who are the key players in Blockchain Insurance Market?

- Who are the market leaders in Blockchain Insurance Market in Europe

- Who are the market leaders in Blockchain Insurance Market in USA and Canada

- Who are the market leaders in Blockchain Insurance Market in India, China, Japan, and South Korea?

- What are the factors affecting growth in Blockchain Insurance Market?

- Who held the largest market share in Blockchain Insurance Market?

- What are the factors for the growth of the Asia-Pacific region in the Blockchain Insurance Market?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2022−2029

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Key Trends

- Market Segmentation – A detailed analysis by Provider, Application, Organization Size, and Region

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Maximize Market Research is leading Information Technology & Telecommunication research firm, has also published the following reports:

Property Insurance Market: Property Insurance Market size was valued at US$ 1.6 Tn. in 2021 and the total revenue is expected to grow at 7.5 % from 2022 to 2029, reaching nearly US$ 2.85 Tn. The property and insurance market is expected to experience significant growth due to rising awareness of the benefits of property insurance because of a series of natural disasters in the last few years.

Crop Insurance Market: Crop Insurance Market was valued at US$ 38.19 Bn in 2021 and is expected to reach US$ 61.34 Bn by 2029, at a CAGR of 6.1% during the forecast period. Numerous governments implement beneficial programs to encourage the farm industry, assisting market growth.

Cargo Transportation Insurance Market: Cargo Transportation Insurance Market was valued at US$ 53 Bn. in 2021. The global Cargo Transportation Insurance Market size is estimated to grow at a CAGR of 3% over the forecast period. The rising awareness and investment of cargo owners, cargo handling companies and logistics owners are leading to the growth of the Cargo Transportation Insurance Market.

Critical Illness Insurance Market: Critical Illness Insurance Market was valued at US$ 121.47 Bn. in 2021. The critical Illness Insurance Market size is estimated to grow at a CAGR of 10.73 % over the forecast period. the market is growing as a result of the critical illness policy’s support for coverage across a number of life-threatening conditions, rising risk of contracting lifestyle diseases, expanding middle class, rising life expectancy, and population expansion.

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

To remain ‘ahead’ of your competitors, request for a sample @ https://www.maximizemarketresearch.com/request-sample/11489

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 96071 95908, +91 9607365656

Media Contact

Company Name: MAXIMIZE MARKET RESEARCH PVT. LTD.

Contact Person: Geeta Yevle

Email: Send Email

Address:3rd Floor, Navale IT Park, Phase 2, Pune Banglore Highway, Narhe,

City: Pune

State: Maharashtra

Country: India

Website: https://www.maximizemarketresearch.com/market-report/blockchain-insurance-market/11489/