Report Overview

The Global Digital Payment Market reached USD 10.1 billion in 2022 and is expected to reach USD 15.6 billion by 2030 and is expected to grow with a CAGR of 5.6% during the forecast period 2023-2030.

Over the past few years, the digital payment market has witnessed an extraordinary surge, driven by growing user awareness of the advantages and convenience offered by digital transactions compared to traditional methods.

Globally, the major players in the Digital Payment Market include MasterCard, Google, Amazon, Alipay, Visa, PayPal, ACI Worldwide, Aurus, Apple Pay, Paysafe and others.

DataM Intelligence’s Global Digital Payment Market report provides insights on the current and forecast market analysis, individual leading Digital Payment companies’ market shares, challenges, Digital Payment market drivers, barriers, trends, opportunities and key market Digital Payment companies in the market.

Global Digital Payment Market Trends

As per DataM estimates, North America is anticipated to hold the largest share of the global Digital Payment market during the forecast period.

Growing Smartphone Use and High Internet Penetration Propel Global Digital Adoption

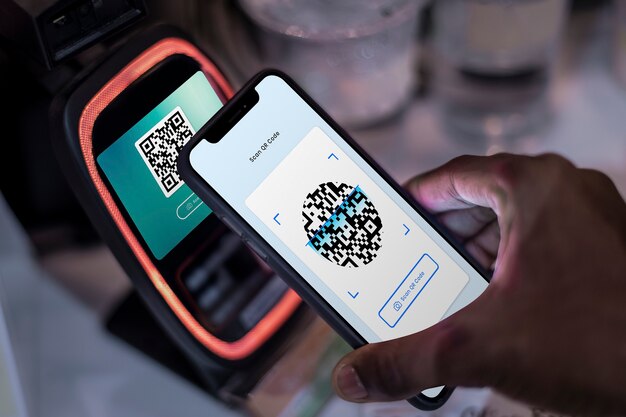

The digital payment market has witnessed significant growth due to the increasing number of smartphone users globally and the easy accessibility of digital payment mobile applications.

Smartphone users in India are projected to surpass 760 million by 2021 and global smartphone users are expected to exceed 3.8 billion by the same year.

Mobile wallets and technological advancements like 5G further boost the adoption of digital payment services.

As global smartphone subscriptions continue to rise, especially in countries like India with growing government initiatives towards digital payments, the market is poised for continued expansion.

Digital payment mobile apps and government initiatives drive market growth opportunities. Easy access and promotion of cashless transactions fuel the expansion.

Government initiatives promoting digital payments and the rise of e-commerce industries fuel market growth opportunities. In India, measures like waiving the merchant discount rate (MDR) for low-cost digital pay have spurred cashless transactions.

Additionally, collaborations like Amazon India offering zero-interest loans to customers for purchasing goods on its website further drive the global digital payment market.

Technical illiteracy, rising cybercrime and technical issues hinder market growth for digital payments.

Digital payments are crucial in increasing bank account penetration. The mobile-based payment bank facility facilitates account access even in technologically unstable regions.

Digital wallets promote financial inclusion, capitalizing on the decreasing number of unbanked individuals worldwide. Despite government initiatives and a rising user percentage, market growth faces hindrances.

India’s 190 million unbanked adults, mostly in rural areas, encounter difficulties with online sales adoption. Cybercrime risks in digital transactions and related technical issues also impede market growth.

For More Insights about the Market: https://www.datamintelligence.com/download-sample/digital-payment-market

North America Dominates the Digital Payment Market

North America leads the digital payment market, driven by numerous solution providers and a developed digital economy. In Canada, factors like reliable infrastructure, cashless payment preference and the banking sector contributed to high adoption rates.

Meanwhile, the Asia-Pacific region is projected to experience rapid growth due to government initiatives, increasing digital payment usage in developing countries, and a thriving e-commerce industry in India, China and Japan.

Next to North America, the Asia-Pacific region’s color concentrate market is set to accelerate due to increasing demand from diverse end-users, economically developed countries and the presence of leading plastic producers.

To know more about why North America is leading the market growth in the Digital Payment market, get a snapshot of the market here.

Digital Payment Market Challenges

Technical illiteracy, rising cybercrime and technical issues hinder the market’s growth for digital payments.

Digital payments play a crucial role in increasing bank account penetration worldwide. Payment bank facilities enable mobile-based account access even in technologically unstable regions, fostering financial inclusion.

However, challenges persist, with approximately 190 million unbanked adults in India facing difficulties in adopting online sales methods, and cybercrime risks and technical issues posing obstacles to market growth.

Digital Payment Market Opportunities

The global digital payment market is fueled by growing smartphone use and high internet penetration. Easy access to mobile applications and government initiatives promoting digital payments create opportunities for market growth.

Technological advancements like 5G are also expected to further accelerate the market’s expansion in the forecast period.

Get a sneak peek at the Digital Payment Market dynamics for a better understanding.

|

Metrics |

Details |

|

CAGR |

5.6% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Type, Application, End-User and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

North America |

|

Largest Region |

Asia-Pacific |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

Know the competitive analysis among the key players of the Digital Payment Market as they are set to emerge as trendsetters in the industry.

Table of Contents

|

1 |

Report Methodology and Scope |

|

2 |

Report Definition and Overview |

|

3 |

Executive Summary |

|

4 |

Market Dynamics |

|

5 |

Industry Factors |

|

6 |

COVID-19 Analysis |

|

7 |

Digital Payment Market Segments and Region |

|

8 |

Global Company Share Analysis – 10 Key Companies |

|

9 |

Digital Payment Market Company and Product Profiles |

|

10 |

About DataM |

Interested in knowing how the Digital Payment market grows by 2030? Click to get a snapshot of the Digital Payment Market Trends

Related Reports

Global Digital Identity Solutions Market

Digital Identity Solutions Market Insights, Competitive Landscape and Market Forecast – 2023-2030 report besides delivering an in-depth understanding of market trends, market drivers, and market barriers, also mentions the key companies with their competitive analysis.

Instant Payment Market Insights, Competitive Landscape and Market Forecast – 2023-2030 report besides delivering an in-depth understanding of market trends, market drivers, and market barriers, also mentions the key companies with their competitive analysis.

Biotech Seeds Market Insights, Competitive Landscape and Market Forecast – 2023-2030 report delivers an in-depth understanding of market trends, market drivers and market barriers. This market is expected to grow tremendously during the forecast period.

Media Contact

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Send Email

Phone: 08774414866

Address:DATAM INTELLIGENCE 4MARKET RESEARCH LLP Ground floor, DSL Abacus IT Park, Industrial Development Area, Uppal, Hyderabad, Telangana 500039

City: HYDERABAD

State: Telangana

Country: India

Website: https://www.datamintelligence.com/research-report/digital-payment-market